Minister for Resources and Energy, Martin Ferguson AM MP today released the Australian Electricity Generation Technology Costs – Reference Case 2010 report in Canberra.

The report was commissioned by the Australian Government and carried out by US-based Electric Power Research Institute (EPRI) as part of Australia’s Energy White Paper process. The report identifies estimated costs of different Australian electricity generation technologies to 2030.

“The speed of change in the global energy sector is unprecedented. The sector is currently faced with the dual challenges of transitioning to a low emission economy while maintaining energy security… This report and subsequent updates to it will improve transparency and understanding surrounding technology costs”, said Mr. Ferguson.

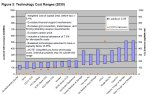

The 2015 scenario shows mature technologies are generally at the low end of the cost range with the exception of Open Cycle Gas Turbines (OCGT).

The 2030 scenario shows that the overall band of levelised costs across all technologies narrows considerably by that year.

The 2030 scenario shows the costs of brown coal fired powered generation accompanied by carbon capture and sequestration (CCS); but whether CCS technology will be commercially viable and broadly adopted by that time remains to be seen. The 2030 scenario does not show the costs of coal fired generation without CCS and with a carbon price in place; the latter being a more likely event than broad adoption of CCS; which would increase the price of coal fired generation significantly.

In the circumstances CCS should be broadly implemented, the technology will not capture all emissions and any carbon price would increase costs in relation to this aspect; costs that were not factored in to the study.

Even given the missing information, the 2030 scenario shows fixed PV (solar panels) generation costing between just under $200 per megawatt hour to just over $400 per megawatt hour. The cost of brown coal fired electricity generation with CCS and without a carbon price applied to any emissions not captured would cost between just over $100 per megawatt hour and just over $200 per megawatt hour.

In terms of emissions, brown coal fired electricity generation with CCS is shown to be slightly under 100 kilograms of carbon dioxide per megawatt hour in the 2030 scenario, with solar PV electricity generation emissions at 0 kg per megawatt hour. Brown coal fired generation in 2015 without CCS will generate approximately 830 kilograms of carbon dioxide emissions per megawatt hour.

Along with needing more energy, and therefore more coal mining; CCS technologies also require increased water consumption and generate more in the way of toxic by-products such as lead and arsenic in fly ash. Additionally, low carbon emissions coal technologies do not lower mercury emissions. The coal fired power generation industry is the largest single contributor to airborne mercury emissions in the world. Whether the costs associated with environmental damage and damage to human health from coal related activities were factored into the report scenarios were unclear in the fact sheet (PDF).