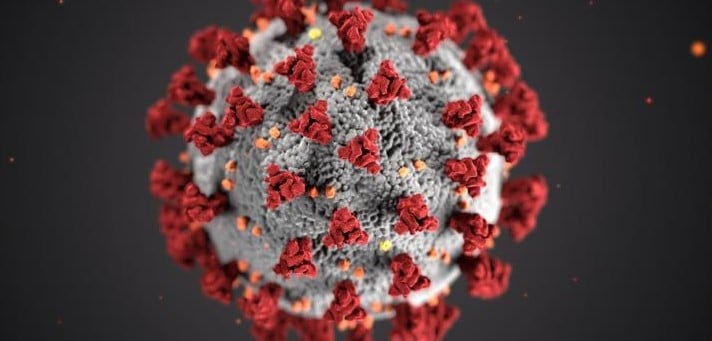

Announced on March 12, 2020, the Australian Government issued a $17.6 billion economic stimulus, in response to the spread of coronavirus and aftermath of the bushfires.

Since then, this boost has increased to $189 billion, after more political talks took place. To put that into perspective, this figure is 9.7 percent of GDP and double the size of the original stimulus given out when the GFC hit.

A majority of the stimulus includes loans and early access to superannuation. It’s estimated $66 billion of this funding will come from tax revenue in the future.

While the Coalition’s response to the virus has come under heavy scrutiny, Australians are now getting serious about the severity of the economic effects.

The stimulus is designed to specifically help support businesses that are feeling the pressure of remaining afloat. It will also provide financial backing for the solar industry, if those looking to enter the market assess the opportunities carefully.

Here’s how the 2020 financial stimulus can help your energy needs

The Australian Government specifically noted that it’s providing a boost for businesses to help manage “cash flow challenges and retain employees”. But within these guidelines, there are a number of ways that companies can utilise this support for energy needs that are no doubt going to increase significantly.

We previously wrote about all the individual benefits the increased instant asset write-off will bring, but beyond this, here’s what you can expect from the stimulus.

As a homeowner

There is no risk to installing solar in relation to COVID-19. Now is a good time to invest in a system and make the most of available financing.

Furthermore, equipping your property with a solar power system will help the economy to make necessary movements towards recovery. You’ll be able to put more money into your wallet for future electricity bills – which are invariably going to rise – and take advantage of credit given out by retailers.

As a business owner

If you have a business loan in place, a majority of banks are deferring repayments for up to six months. While this isn’t directly a part of the stimulus, it will provide companies across the board much needed relief, and the opportunity to grab assets like solar.

Beyond this, tax deductions have been increased on a range of business-related investments. For companies looking to install a solar system, this is the perfect way to get into the market.

Solar retailers

Retailers have had to adapt to the changes of COVID-19 and ensure face-to-face contact isn’t mandatory. To combat this, paperwork is streamlined in the initial stages, and now allows consumers to get their system without the need to physically meet with a potential installer.

This means retailers still sit in a low-risk zone when it comes to feeling the burden of business decrease and economic effects. There’s still plenty of opportunity out there.

IMPORTANT: It’s crucial that social distancing regulations are followed, in order to ensure there’s minimal risk to both yourself and the community. If you’re not sure how to action this, please read up on the guidelines here.

If you’re an installer, for example, the government is providing $20,000 to $100,000 as a subsidy to anyone who pays staff and has a turnover of less than $50 million. This allows smaller companies (like retailers and installers) to keep their employees’ PAYG tax.

When October rolls around, businesses will also receive an additional boost that’s equal to how much they kept.

To find out more information on how this cash flow boost will work, click here.

RELATED: WA introduces coronavirus COVID-19 stimulus package