ClearVue Technologies Limited, an Australian smart building materials company, recently made headlines by securing a $30 million At-the-Market Facility (ATM) Agreement with Alpha Investment Partners. This funding facility is a significant step for ClearVue as it bolsters the company’s financial position and supports accelerating its development in the field of ClearVuePV IGU glazing products and the integrated ClearVue Solar Facade solution. In this article, we will delve deeper into the details of this solar PV agreement, its implications, and the companies involved.

Are you looking to save money on your electricity bills and reduce your carbon footprint? Solar energy is the perfect solution! Energy Matters can help you get up to 3 FREE quotes from pre-qualified and vetted solar firms in your area.

Energy Matters has been a leader in the renewable energy industry since 2005 and has helped over 40,000 Australian households in their journey to energy independence. With Energy Matters, you can be sure you’re getting the best possible deal on solar energy. We only work with reputable solar firms with a proven track record of delivering high-quality solar systems.

Key Highlights

- ClearVue secures $30 million ATM funding facility with Alpha Investment Partners

- ATM facility will support ClearVue’s market entry and expansion plans

- The facility provides ClearVue with access to cost-effective standby equity capital over a five-year term

- ClearVue retains full control over all major aspects of the placement process

- There are no restrictions on ClearVue raising capital through other methods

ClearVue's ATM Facility with Alpha Investment Partners

On October 23, 2023, ClearVue Technologies Limited announced a five-year ATM facility agreement with Alpha Investment Partners, a strategic move has garnered much attention in the financial and technology sectors. The ATM facility is set to provide ClearVue with up to $30 million of standby equity capital over the next five years. This significant financial boost is expected to play a pivotal role in ClearVue’s market entry and expansion plans.

One of the standout features of this facility is that it provides ClearVue with greater flexibility for conducting capital-raising activities over time. The company retains complete control over the key aspects of the placement process, including whether to use the ATM, the number of issued shares, and the minimum issue price for any placement. The final issue price is calculated as the greater of a floor price set by ClearVue and a Volume Weighted Average Price (VWAP) over a specified period minus a discount of up to seven per cent.

Advantages of ClearVue's ATM facility

The ATM Facility offers several key advantages for ClearVue Technologies:

Timing control: One of the primary benefits of the ATM Facility is the control it affords ClearVue over the timing of capital issuances. This control is essential for optimising the net proceeds with minimal dilution.

No complex mechanisms: Unlike structured financing solutions, the ATM Facility doesn’t involve complicated or expensive mechanisms. It simplifies the process of capital raising.

No restrictions: ClearVue is not restricted from raising capital through other methods simultaneously. This ensures maximum flexibility in their financial strategy.

Collateral and buyback option: ClearVue has agreed to place 10 million shares from its LR7.1 capacity to Alpha Investment Partners as collateral for the ATM facility. Importantly, ClearVue can buy back these shares without incurring termination costs, subject to shareholder approval.

ClearVue's CEO Martin Deil's perspective

Martin Deil, CEO of ClearVue, highlighted the significance of this ATM Facility in the company’s growth strategy. He emphasised that ClearVue’s technology had been validated by third-party verification, affirming the real-world performance benefits of their products. Access to flexible capital is critical to accelerating their growth plans and commercialisation efforts. The ATM Facility empowers them to raise investment at prevailing market prices and adapt to market dynamics effectively.

Deil also noted that while ATM facilities have been widely used in the US, they are relatively new in Australia. The ClearVue team reviewed multiple fundraising options before choosing this ATM, and they view it as a prudent step to efficiently and cost-effectively meet investor demand as they scale their execution in multiple global markets.

About ClearVue Technologies Limited

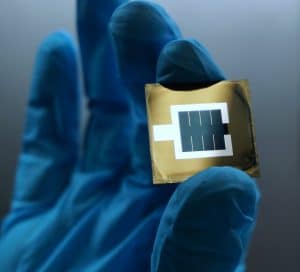

ClearVue Technologies Limited (ASX: CPV) operates in the Building Integrated Photovoltaic (BIPV) sector, specialising in integrating solar technology into building surfaces, particularly glass and building facades. Their technology is designed to maintain glass transparency while generating electricity. ClearVue’s glazing technology has applications in various industries, including building and construction, and it aims to contribute to global energy efficiency goals.

About Alpha Investment Partners

Alpha Investment Partners (AIP) is a dedicated investment group focused on small and mid-cap ASX-traded companies. They aim to provide balance sheet capability to support operational growth programs. AIP’s team brings extensive global capital markets experience and a strong track record in global markets.

Source&Images: ClearVue

ClearVue Technologies’ $30 million ATM Facility Agreement with Alpha Investment Partners is a significant development that enhances the company’s financial strength and provides greater flexibility for its growth plans. This strategic move positions ClearVue to efficiently raise capital and navigate market dynamics effectively as they expand their innovative building-integrated photovoltaic solutions globally.

Read more about solar PV glass

Still can’t afford to switch to solar power?

Are you considering getting solar panels but are currently short on funds? You can still invest wisely, and Energy Matters can help you.

Powow and Energy Matters have teamed up to provide consumers with an alternative to switching to solar power and battery storage.

The biggest obstacle to installing solar and battery storage is typically finance. With Powow’s PPA and VPP, our customers will have a $0 upfront option and financial stability in the uncertain energy market.

Get up to 3 obligation-free quotes by getting in touch with us right away. Find out what payment plan options suit your needs and budget!