Columbia University has joined the growing ranks of higher learning institutions to begin divesting from coal.

The University’s Trustees announced last week it would be dumping investments in companies that derive more than 35% of their revenue from the production of thermal coal.

Additionally, the University will begin participating in the Carbon Disclosure Project’s Climate Change Program.

“Divestment of this type is an action the University takes only rarely and in service of our highest values,” said University President Lee C. Bollinger. “Clearly, we must do all we can as an institution to set a responsible course in this urgent area.”

The University was also urged by the Trustees to do more towards lightening its own carbon footprint. Something the University doesn’t have a lot of (or any it seems) is solar energy – but that will start to change soon. Columbia’s Lamont-Doherty Earth Observatory has announced it will rely on solar power for 75% of its electricity needs.

Earlier this month, two universities in the UK also jumped on the fossil fuel divestment bandwagon – University of Bristol and King’s College London. In the case of the latter, the university will divest from all fossil fuels by 2022.

Closer to home, Queensland University of Technology (QUT) committed to divesting its shares in fossil fuels in September last year, joining ANU, La Trobe University and the University of Sydney in divestment commitments.

Universities all over the world have come under increasing pressure to divest from fossil fuels. On the Fossil Free site, 584 campaigns are currently listed.

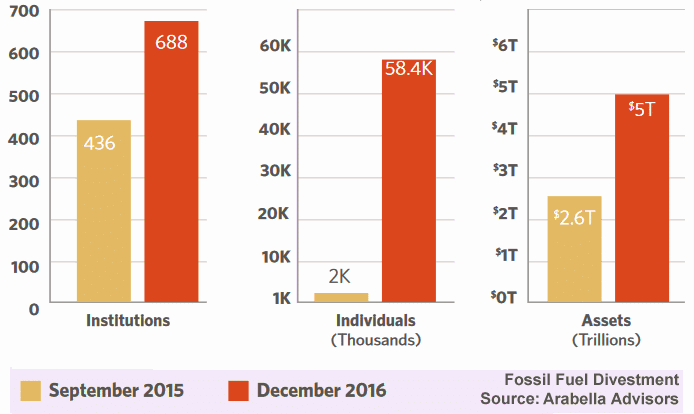

Looking at the bigger picture, a December report from Arabella Advisors states the value of assets represented by all institutions and individuals committing to some sort of divestment from fossil fuel companies had reached an astounding USD $5 trillion.

As an indicator of how fast the pace of divestment is picking up, in September 2015 we covered another report from Arabella Advisors, stating at that point in time USD $2.6 trillion in assets had been divested.

With the fossil fuel divestment revolution really kicking into gear and the writing on the wall for the little black rock, it may leave some wondering why anyone would even consider pouring billions into new gigantic coal mines – or “clean” coal power generation for that matter.