RateSetter Australia and the Clean Energy Finance Corporation (CEFC) have announced an 18-month extension of their green loans program.

Launched in 2017, RateSetter’s green loan marketplace was the CEFC’s first investment in a peer-to-peer lending platform.

The program provides affordable loans to households and businesses for purchasing renewable and energy efficient products. The CEFC provided RateSetter with $20 million in seed funding to establish the marketplace.

In the first year alone, over 1,000 households and small businesses accessed the green loans scheme.

This success has led to the decision to extend the program by a further 18 months.

“We’re pleased to see this strong early response to the RateSetter green loan marketplace from borrowers and investors,” said Richard Lovell, CEFC’s Debt lead.

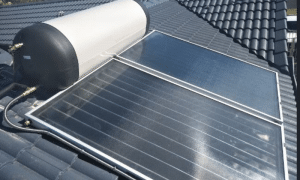

Loans finance solar power, storage and efficiency measures

RateSetter currently offers green loans of $2,000 – $45,000 at 7.9% p/a. These loans have helped finance a range of green products, including solar power systems and battery storage.

In the past year, solar power purchased through the program has resulted in a reduction of over 2,250 tonnes of CO2 emissions annually.

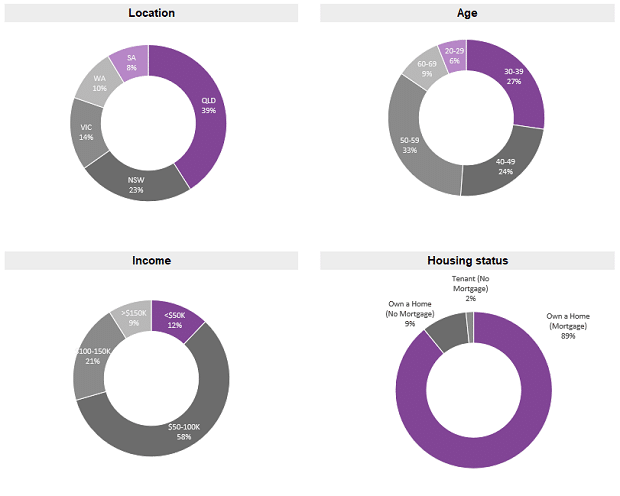

Interestingly, RateSetter notes that 9 out of 10 green loans go to homeowners. The company said this demonstrates a strong desire among mortgage holders to make their homes more energy efficient.

Many of these households used the program to purchase solar power. This trend meant sunny Queensland topped the ladder for green lending, followed closely by NSW.

Households in the 50-100k income bracket were most likely to access loans.

Green loans program a win for investors and borrowers

The solid growth of the scheme over the past year has also attracted private investment. RateSetter said retail and other institutional investors have shown strong interest in the green loan marketplace.

In addition to the CEFC, over 200 retail investors have financed green loans, earning up to 6.5% per annum.

The peer-to-peer green loans program allows investors to nominate the amount they wish to lend along with the interest rate they want.

Customers installing solar panels found that, even after loan repayments, they were spending less on power in the first month, with the system expected to pay for itself after 5-6 years, but lasting for up to 20.

“Continued reductions in the cost of solar systems coupled with low cost finance makes these products a smart choice for many more Australians,” said RateSetter CEO Daniel Foggo.